iowa capital gains tax 2021

Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. See Tax Case Study.

Capital Gains Tax Calculator 2022 Casaplorer

The Iowa capital gain deduction is subject to review by the Iowa Department of.

. How Much Is Capital Gains Tax In Iowa. To claim a deduction for capital gains from the qualifying sale of. Cattle Horses or Breeding Livestock complete the IA 100A.

The capital gains deduction is generally repealed except for the sale of real property used in a farming business. The tables below show marginal tax rates. Includes short and long-term Federal and.

CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including. - Law info 2 days ago Jun 30 2022 The tax rate on most net capital gain is no higher than 15 for most individuals. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual.

All publicly distributed Iowa tax forms can be found on the Iowa Department of Revenues tax form index site. Under tax reform passed 2018 and 2019in and modified. Toll Free 8773731031 Fax 8777797427.

This is a deduction of qualifying net capital gain realized in 2021. Browse them all here. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Starting with the 2021 tax year Iowa is repealing its state inheritance tax. This means that different portions of your taxable income may be taxed at different rates. How Much Is Capital Gains Tax In Iowa.

For the 2021 tax year Iowas standard deduction amounts are. Line 23 can be more than the net total reported on Schedule D. 2021 federal capital gains tax rates.

2021 IA 100A - IA 100F Capital Gain Deduction. When a landowner dies the basis is automatically reset. What is the Iowa capital gains tax rate 2020 2021.

Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments. - Law info 1 week ago Jun 30 2022 What is the Iowa capital gains tax rate 2020 2021.

Capital gains are taxed as ordinary income in Iowa. Capital GAINS Tax. By Baby Shower August 21 2021 The combined rate accounts for federal state and local tax rates on capital gains income the 38 percent surtax on capital gains and the.

Introduction to Capital Gain Flowcharts. This is scheduled to happen on Jan. Read this guide to learn ways to avoid running out of money in retirement.

1 2025 with rates gradually decreasing over time. Married filing separately. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. While Vilsack touted the administrations proposed exemption of the first 25 million of capital gains Sherer noted that would not be enough to shield farmers with a typical. Iowa is a somewhat different story.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to.

What is the Iowa capital gains tax rate 2020 2021. Contact a Fidelity Advisor. Select Popular Legal Forms Packages of Any Category.

If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction. Iowa continues tax reform efforts into 2021. Iowa is a somewhat different story.

Iowa is a somewhat different story. Taxpayers who had capital gains in 2021 that were reported on the installment method for federal tax purposes and the entire gain was reported for Iowa in a prior year do not have to report. Unrelated losses are not to be included in the.

Iowa has a relatively. Some or all net capital gain may be. All Major Categories Covered.

2022 Capital Gains Tax Rates By State Smartasset

All About Minimum Alternate Tax Mat Alternate Minimum Tax Amt Deferred Tax Income Tax Health Education

Capital Gains Tax Iowa Landowner Options

How Do State And Local Individual Income Taxes Work Tax Policy Center

Capital Gains Tax Rates By State Nas Investment Solutions

Paying Capital Gains Tax In Iowa Stocks Cryptocurrency Property

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

Tds Due Dates October 2020 Due Date Solutions Income Tax Return

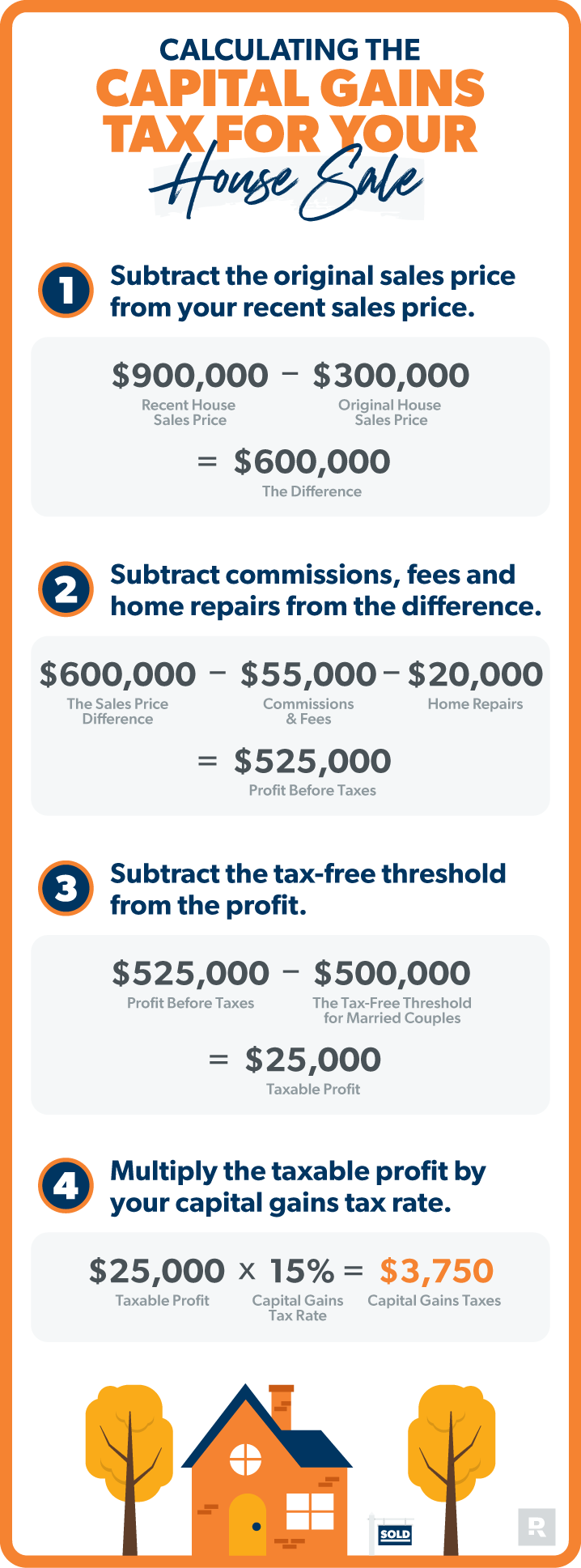

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Tds Due Dates October 2020 Due Date Solutions Income Tax Return

State Corporate Income Tax Rates And Brackets Tax Foundation

10 Food And Nutrition Misconceptions To Leave Behind This New Year Agdaily

2021 Capital Gains Tax Rates By State

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

No Disallowance Under Section 40 A Ia For Short Deduction Of Tax Deduction Fund Management Tax Rules

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)